Culinary school students already have a lot to juggle. They don’t need financial stress on top of it all.

Whether you are moving out on your own for the first time, attending culinary school online while living at home, or just want to keep better track of your personal finances, making a budget can help.

Far from being a source of restriction, a budget can actually be a tool of freedom! Wouldn’t it feel great to pay all of your bills, and know that you can still enjoy a night out to dinner with your friends?

These steps can show you how to make a budget to help you save money and build healthy spending habits during culinary school.

Note: Auguste Escoffier School of Culinary Arts does not provide financial advice. Always consult with a professional to determine what is best for your situation.

1. Start By Determining Your After-Tax Income

All budgets begin with your total income. Until you know how much money you have to spend each month, you can’t create a smart budgeting strategy.

If you earn a salary, this is easier to determine. A regular salary creates a steady, predictable cash flow. Just make sure to look at after-tax income—also known as take-home pay or net pay—since that’s the money you’ll have to work with.**

If you work hourly and your schedule varies (which is often the case in restaurants and bakeries), it can be more challenging to estimate how much you’ll earn each month. The hospitality industry often sees seasonal peaks and valleys, which can lead to more income in busy months and less in slower months.

Figure out how much you have to spend before you go any further with your budget!

The best way to approach a varying schedule could be to work from a minimum monthly income—the amount that you know you’ll bring home each month, barring an unexpected emergency. That way, any income over that minimum can be treated like a bonus that you can use for savings or to pay down debt. But it’s not income that you’re relying on in your month-to-month budget strategy.

2. Use the 50/30/20 Rule to Categorize Down Your Spending

Once you have your monthly income number, you can start allocating those dollars to various spending categories. A good framework is the 50/30/20 rule, where 50% of your income goes to needs, 30% to wants, and 20% to savings and paying down debt.

Allocate 50% of Income to Needs

This is the largest part of your budget, and it includes the expenses that you must cover each month. Your list may vary, but consider:

- Rent or a mortgage payment

- Groceries

- Insurance for your health, home, and/or car

- Utilities including electricity, gas, water, internet, and phone plans

- Transportation like car payments, gas, or bus/train fare

- Minimum debt payments, like credit cards and student loans

- Child care

- Culinary school payments or expenses

Many of these costs, like rent and insurance, are fixed expenses. This means they don’t vary from month to month. Others, like groceries and some utilities, are variable expenses. These costs may fluctuate based on the type of food you buy or the weather.

Online culinary school students at Auguste Escoffier School of Culinary Arts should include the ingredients for their cooking assignments in their budgets. At the beginning of each course, students get access to the recipes for the term. This includes a shopping list for each week, showing all perishable and nonperishable items they’ll need to complete the assignments.

Students can then build these costs into their monthly budgets, and look for opportunities to save. For example, they may be able to purchase nonperishable items in advance if they’re on sale, or buy some perishable items in bulk and then freeze them until they’re needed.

Tracking your grocery spending can help you to cut costs during culinary school.

Allocate 30% of Income to Wants

This category includes anything that’s not required for you to live, work, and attend school. Consider expenses like:

- Entertainment

- New clothes

- Dining out

- Travel

It’s important to allocate some of your income to having fun! Going to the movies, spending a weekend away, or dining out with friends can help you to maintain a healthy work-life balance and reduce the chances of burning out.

Include “wants” like dining out so you can still have fun—while sticking to your budget.

Allocate 20% of Income to Savings and Paying Down Debt

How you split this 20% will depend on your personal circumstances. If you have minimal debt, then you can prioritize savings. Many experts recommend building and maintaining an emergency fund equal to about three to six months of expenses. This can help to cover unexpected costs like car trouble or minor medical problems.

You may also wish to start a retirement account. Some employers set up retirement accounts on behalf of their employees, like 401(k)s. But you can also start an individual retirement account (IRA) that you can contribute to each month.

If you’re facing low-interest debt, you may choose to simply make the minimum payment each month (which would be covered in the “Needs” category). But if you have high-interest debt like a credit card, you may choose to focus more of this category on paying down that debt.

Credit card debt can get very expensive! The average credit card interest rate in the United States in March 2023 was 24.15% (but this average can vary – even daily!) But they can reach 29% or higher. If you have this kind of debt, you may want to focus on paying it off quickly.**

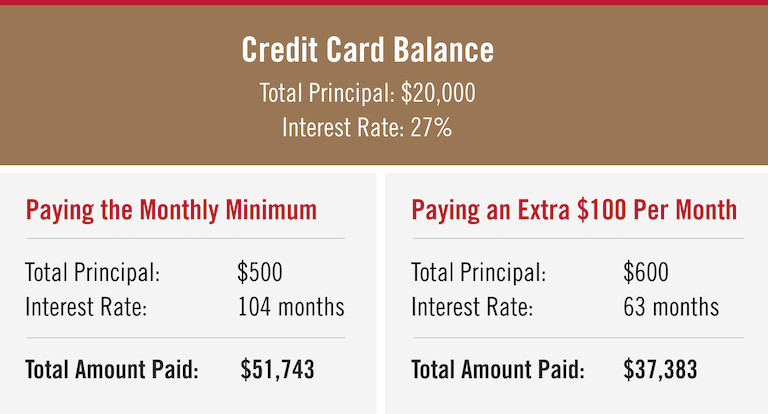

How Much Is Your Credit Card Debt Costing You?

Let’s say a student owes $20,000 on his credit card with an interest rate of 27%. His minimum monthly payment is $500.

If he only pays the minimum due each month, it will take 104 months to pay off the balance. That’s over 8.5 years. And he would pay the principal of $20,000, PLUS $31,743 in interest. That means he’d pay a total of $51,743.

If he pays just $100 extra per month, it would take 63 months to pay off the balance, or 5 years and 3 months. But the amount he’d pay in interest would be slashed to $17,383. So his overall amount paid, between the $20,000 principal and the interest, would be $37,383. Just paying an extra $100 per month saves him over $14,000!

Use this credit card payoff calculator to figure out how much your own credit card could be costing you.

Tweak These Budget Categories For Your Specific Situation

The 50/30/20 breakdown may not work for everyone. Perhaps you want to prioritize paying off debt. You could choose to spend 20% on wants and 30% aggressively chipping away at your debt.

Or perhaps your needs take up more than 50% of your income. In this case, you can look for ways to reduce your spending on needs and/or a way to make additional income. Shopping for a cheaper phone plan or eliminating a few digital subscriptions, for example, could help you save each month.

You may also choose to organize these categories further. For example, you could allocate a certain dollar amount to dining out, and a certain amount to new kitchen gadgets. By dividing your spending into specific categories, it’s much easier to see where your money is going so you can focus on what’s really important to you!

3. Decide How You’ll Manage Your Budget

What gets measured gets managed. So it’s important to choose a method for tracking your spending.

There are many ways to do this. One of the easiest is to use a simple spreadsheet. There are templates available online that already have fields set up for various spending categories. You can update your spreadsheet once a week to make sure you’re on track. Do it over a cup of coffee and make it a fun check-in!

There are also higher-tech options. Apps like Mint, You Need a Budget, and PocketGuard can sync with your bank accounts, automatically pulling your purchases into the app and categorizing them. Some of these apps have free versions, while others may require a monthly or annual subscription fee.

“Construct a budget and only borrow what is needed to cover your school expenses such as tuition.”*

Jason Rodriguez, Escoffier Director Of Financial Aid

4. Automate Your Bills and Savings

The best budgets and financial plans are the ones that work on autopilot! Some parts of the budgeting process can be automated, including paying many bills and putting money into savings accounts.

Through your bank’s website or through the vendor’s website, you may be able to set up automatic online bill pay. By automating your bill payments, you may prevent missed payments, late fees, and interest charges, helping to keep your budget on track. On-time payments can also help you to build a strong credit score, which may help when it’s time to buy a home or car, or apply for loans or credit.

You may also wish to automate your savings. It is usually easy to set up transfers between checking and savings accounts, especially if they’re held at the same bank. Create a recurring monthly transfer into your savings account each month, so you can “pay yourself” without even thinking about it. Or if you get paid by direct deposit, ask your employer to automatically deposit a fixed percentage of your income directly into your savings account!

Online banking tools may make it easy to automate your bill payments and personal savings.

5. Check In Often to Assess Your Progress and Make Adjustments

However you choose to track your spending, make sure you do track it, and check in on your progress often.

Watching a savings account grow or a debt balance decrease can be very motivating! Plus, you may need to make adjustments. Perhaps you notice that you’re going slightly over budget on your “wants” each month. You may need to pay closer attention to your discretionary spending. Or if you’re spending more on groceries than you planned, you can look for more affordable meals or cost-cutting measures for your online culinary school ingredients.

Remember that a budget is a tool, not a mandate. If something isn’t quite working for you in this season of your life, you can (and should) make adjustments until it does. Perhaps during your time in culinary school, your fixed expenses will be a larger proportion of your budget. That’s okay, as long as you can still cover your needs, indulge on a few wants, and contribute to your savings.

Make checking in on your savings goals and budget status a part of your weekly routine.

Build a Smart Spending Plan

Now that you’ve been through budgeting 101, you may be ready to take control of your finances! Making a budget could help you to reach your savings goals, get out of debt, or simply keep financial stress at bay while you’re in culinary school.

Ready to put that budget into action? Contact our Admissions Department to get details about our programs in culinary arts, baking and pastry arts, food entrepreneurship, plant-based culinary arts, holistic nutrition and wellness, and hospitality and restaurant operations management. Find out how long your program could take, what you may learn, and what could be on the other side of your degree or diploma!

To learn more about financing your culinary school education, try these resources next:

- 7 Steps to Making a Financial Plan for Culinary School

- Is Culinary School Expensive?

- 6 Ways to Afford Culinary School If You’re a High School Student

*Information may not reflect every student’s experience. Results and outcomes may be based on several factors, such as geographical region or previous experience.

**Note: Auguste Escoffier School of Culinary Arts does not provide financial advice. Always consult with a professional to determine what is best for your situation.

“Construct a budget and only borrow what is needed to cover your school expenses such as tuition.”*

“Construct a budget and only borrow what is needed to cover your school expenses such as tuition.”*