How long does it take to pay back student loan debt? Typically around 10 years, if you borrow under the Federal Stafford Loan program.*

But are student loans worth it? The answer to this second question requires more thought.

If, for example, your goal is to work as an executive chef, start your own restaurant, or find your dream job in the culinary industry…

…And if you believe that going to culinary school could make your dream a reality…

The right question to ask yourself might be:

What’s The Cost of Not Pursuing Your Dream?

Obviously, if you can go to culinary school without taking on loans, you should. Auguste Escoffier School of Culinary Arts financial aid advisors can assist you in understanding all of the scholarships, grants, and other financial aid options that you may qualify for before taking out loans.

But if the question comes down to going to culinary school with student loans or not going to school at all, what would that cost you?

What’s the cost of working in a job you don’t enjoy? What’s the cost of delaying your life goals?

If you’ve never borrowed money before—or if you already have debt and don’t want to take on more—thinking about loans can be scary. But it doesn’t have to be.

Once you understand how much you’ll need to borrow, how and when you’ll pay it off, and how your life could change in terms of career opportunity and potential earning power…it can become much easier to evaluate your decision.**

If you decide that your dreams shouldn’t be delayed any longer and you’re finally ready to take the next step, let’s see what borrowing for culinary school might look like for you.

What Aid and Loans Do You Qualify For?

Since financial aid includes grants and scholarships that don’t need to be repaid, it makes sense to explore those options before considering a loan. That’s why the first step in the financial aid process is always completing the Free Application for Federal Student Aid form (FAFSA) for culinary school.

The main purpose of completing the FAFSA is to determine your Expected Family Contribution (EFC)***. This number is used to assess if you’re eligible for federal aid, and how much need-based aid you may get. You’ll need your tax information (and your parents’ if you’re a dependent) in order to complete the FAFSA.

What do you do if you’re a dependent student, and you’re having difficulty gathering tax information from either or both parents? The best course of action is to coordinate a conference call with your parents and an Escoffier Financial Advisor to help clear up any confusion.

Student Loan Information for Parents of Dependent Students

Federal law typically (not in every case) requires that dependent students submit both parents’ tax information on the Free Application for Federal Student Aid (FAFSA) form. Failure to do so can delay an applicant’s entry into school, as well as disqualify them from certain forms of financial aid. It’s important to understand that submitting information on a FAFSA form does not make any kind of financial commitment. It’s not a loan application and has zero impact on credit scores because no credit inquiry is made.

For parents who wish to support their students financially in school, ask an Escoffier Financial Aid Advisor if you qualify for a low-interest PLUS loan, which currently offers a 7.54% interest rate for the 2022-2023 academic year. These loans do require a credit check, which may temporarily reduce your credit score by a few points. If you have more questions, a short call to a Financial Aid Advisor can help clear up any confusion and answer your questions.

It’s important to understand that providing information for a FAFSA doesn’t commit either parent to any kind of loan. However, low-interest loans may be available to those who apply and qualify, and everyone’s financial circumstances are different. So a call with an Escoffier representative can help you understand the various options that may be available to you and your family.

With a completed FAFSA in hand, your financial aid advisor can then help you determine your financial need, use the EFC to assess which aid and loans you can apply and qualify for.

Student Loan Information for Independent Students

Independent students have access to many, but not all, of the same types of loans as dependent students and their parents, with the exception of the Parent Plus Loan. Instead of reporting their parents’ information on the FAFSA, they report their own (and their spouse’s, if they are married). Your answers to the questions on the FAFSA itself determine whether or not you are dependent or independent, so simply completing that form is the best step if you are unsure. You can also refer to this article on the StudentAid.gov website for more information about independent versus dependent status.

Why Stafford Loans Make Sense

76% of Austin students and 54% of Boulder students who entered postsecondary education for the first time received some financial assistance in 2021-22 for those who applied and qualified. And most of that came in the form of direct federal student loans, also known as Stafford Loans. These loans, in fact, are the single largest source of federal student aid, with more than 37 million borrowers nationwide.

The reason to choose Stafford Loans is simple: the interest rate for these loans is often lower than private loans.

There are three types of Federal Direct Stafford Loans you’ll want to consider when making the decision to go to culinary school: subsidized Stafford Loans, unsubsidized Stafford Loans, and PLUS Loans.

1. Subsidized Stafford Loans

Subsidized Stafford Loans have an interest rate of 4.99% for undergraduate students for the 2022-2023 academic year. The benefit of subsidized loans is that the government pays your interest for as long as you are in school. The results of your FAFSA will determine how much you may borrow in subsidized loans.

2. Unsubsidized Stafford Loans

Unsubsidized Stafford Loans also have an interest rate of 4.99% for the 2022-2023 academic year. But they begin accruing interest as soon as they are disbursed. Payments are not required for either type of loan until after completing your education, as long as you maintain your full-time student status.

The amount you may borrow in unsubsidized loans is also determined by your FAFSA results.

Stafford Loan Borrowing Limits for the 2022-2023 School Year

| School Year | Dependent Students |

Independent Students (and dependent students whose parents can’t get a PLUS Loan) |

|---|---|---|

| 1st Year Undergraduate Students | $5,500 (up to $3,500 in subsidized loans) | $9,500 (up to $3,500 in subsidized loans) |

| 2nd Year Undergraduate Students | $6,500 (up to $4,500 in subsidized loans) | $10,500 (up to $4,500 in subsidized loans) |

3. PLUS Loans

The Parent Loans for Undergraduate Students (PLUS Loans) are available to parents of dependent students. These loans are not based on need, so they can be valuable for bridging any financing gaps left by Stafford Loans. The interest rate for PLUS loans is 7.54% for the 2022-2023 academic year.

Note that these interest rates are subject to change. See the Federal Student Aid website for the latest information.

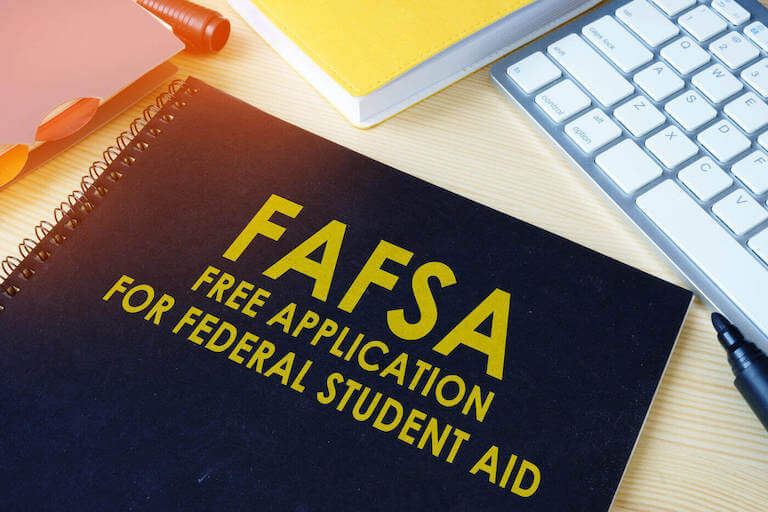

The Essential Culinary Career Survey

The Essential Culinary Career Survey

What's your ideal culinary career: Fine dining? Your own restaurant? Pastry? Get our self-evaluation survey to find out!

We’ve compiled a checklist of all of the essential questions into one handy guide: career options, culinary interest surveys, educational opportunities, and more.

Paying Back Your Student Loans

Upon graduation (or if you leave school early), you traditionally must begin to pay back student loan debt after a 6-month grace period. There are a number of repayment plans available, including standard (fixed monthly payments over 10 years), or graduated (lower payments in earlier years, followed by an increase in later years).

There’s also an extended payment plan of up to 30 years for students and parents who decide to consolidate their student loan debt. You can change repayment plans at any time, for free. Be sure to speak with your loan servicer to help find the right repayment program for you.

What Happens If You Can’t Pay Back Your Student Loans?

If you are going through a hard time, in between jobs, or facing a crisis, the Department of Education has many options on loan repayment, including lowering or postponing payments. Escoffier’s Financial Aid Advisors can help you explore which option might be best for your specific situation.

Are Student Loans Worth It…If They Can Help You Achieve Your Career Goals?

Is a student paying $100-$200 over ten years worth it? Now we have the right question, plus an understanding of how to answer it.

In the examples above, would that student paying $100 to $200 per month over ten years believe it’s worth it? If an education helps him or her move towards their dream of opening a restaurant, working towards an executive chef position, or launching a new career path in life, the answer may become more clear.

Of course, there are no guarantees in life. Circumstances can change, and there are risks in any endeavor. Just having a culinary education doesn’t guarantee anything, but it can be the first step towards a rewarding career and a larger plan. And a student loan can help make that step happen sooner rather than later.

Remember, borrowing money to go to school should be done responsibly, with a specific vision for your life in mind. If you’re wondering which academic path is right for you…

If you want guidance on clarifying your culinary arts or pastry arts goals…

And if you want to gain clarity on financing your education with loans, scholarships, and other aid, request more information today, and we’ll help you figure out your next steps.

More information on financing your education:

- Is Culinary School Expensive?

- A Practical Guide to Culinary School for Active Military, Veterans, And Their Families

- Can You Deduct College Tuition From Taxes?

This article was originally published on January 8, 2021, and has since been updated.

*Information may not reflect every student’s experience. Results and outcomes may be based on several factors, such as geographical region or previous experience.

**Consider your situation and resources to determine what is affordable and on budget, for you.

***Please view the most recent requirements to determine what is needed for the Expected Family Contribution (EFC).